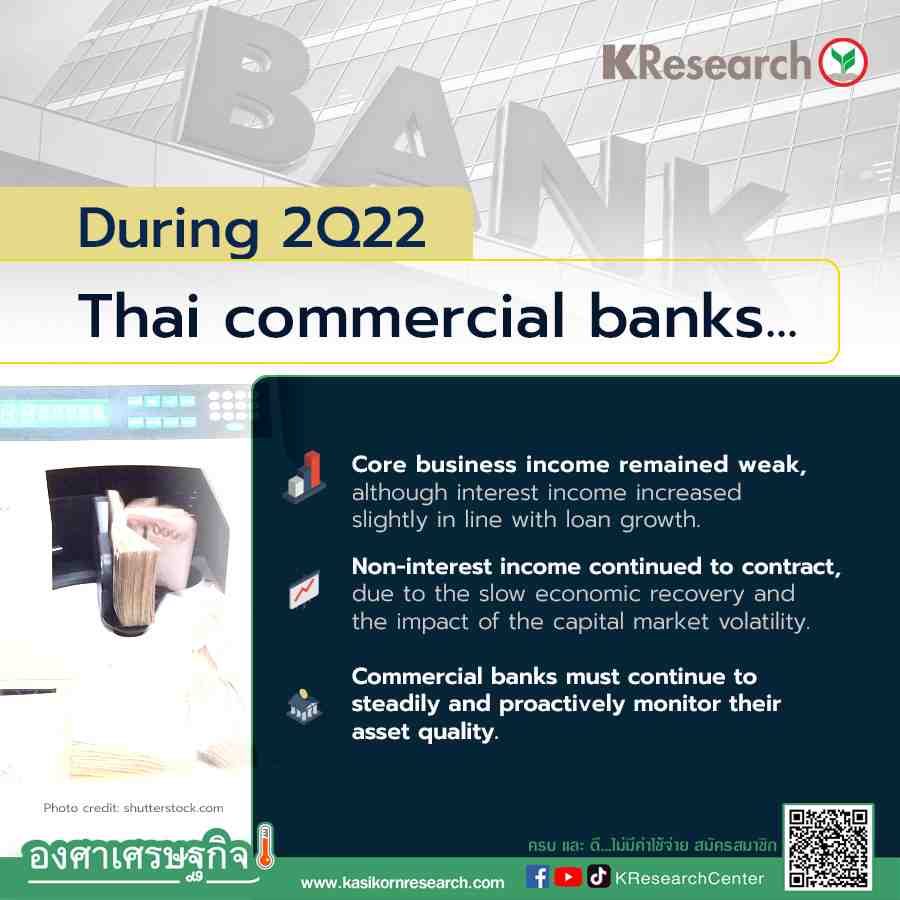

KResearch assesses that core business income of commercial banks in Thailand remained weak during the second quarter of 2022. Particularly, their non-interest income was pressured by murky economic conditions, while volatility in the capital market also hurt their investment portfolios. However, net interest income is likely to increase only slightly with loan growth driven by business loans and unsecured loans, resulting in the ratio of net interest income to average interest-earning assets, or NIM, which is likely to increase to 2.58% from 2.55% in the first quarter of the year. In addition, commercial banks have steadily and proactively supervised their asset quality by accelerating efforts in addressing asset quality problems, sale of NPLs, bad debt write-off and debt restructuring for their borrowers. As a result, the banking system’s ratio of non-performing loans to total loans during the second quarter remained in the range of 2.90-2.93%, which was almost on par with the level of 2.93% in the first quarter.

In spite of this, close attention must be paid to deteriorating signs seen in the quality of SME and retail loan portfolios such as home loans, credit card loans and unsecured personal loans. According to the overview of the abovementioned operating income, we expect net profit of commercial banks will reach approximately THB46.1 billion during the second quarter, a 19.6 percent decline YoY, against the high base of the second quarter of 2021 for which a special profit item from a commercial bank’s investment and selling of its subsidiary’s shares was recorded.

Looking into the remainder of 2022, it is expected that favorable economic signs will help support loan drawdowns, thus easing pressure on other parts of commercial banks’ core business income somewhat. For this reason, KResearch has revised our 2022 loan growth forecast for Thai commercial banks to 5.0 percent or within a new forecast range of 4.0-5.5 percent, which is higher from the previous forecast in March 2022 at 4.5%. However, interest spread among commercial banks may not fully reflect the benefit of a policy rate hike because liquidity within the commercial banking system remains high and problems seen in many debtor segments during the current transition period have not received positive effects from the recovery in economic activity either. Therefore, commercial banks may raise interest rates for certain types of loans and deposit products during the initial phase.

Regarding the overall core business income of commercial banks in 2H22, due to the restricted growth seen in fee income, it may take a while for some commercial banks to enjoy earnings from new businesses. It is expected that pre-provisioning and tax operating profits of commercial banks in Thailand will reach THB401-403 billion in 2022, which would not be a return to the average figure reported during the 3-year period before COVID-19.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.