Net zero emissions (Net Zero) has become a goal not only for policymakers to drive the country to achieve the targeted goals, but the private sector is also a key player in driving and reducing its impact on global warming under the goal of doing business with the Net Zero business model. Currently, 1,631 companies around the world including 44 Thai companies1 have set goals for Net Zero emissions. Actions to reduce greenhouse gas emissions can be implemented in a variety of ways such as increasing production efficiency, changing technology, using clean energy, planting forests or developing technology to absorb/store greenhouse gases, and purchasing carbon credits to offset greenhouse gas emissions.

Importance of carbon credit trading project

At present, Thailand’s carbon credit acquisition mechanism is implemented through the establishment of the Thailand Voluntary Emission Reduction Program or the T-VER project developed by the Thailand Greenhouse Gas Management Organization (TGO). Carbon credits gained from project implementation can be used to offset greenhouse gas emissions (Carbon Offsetting) on its own or sold to those who want to reduce their greenhouse gas emissions but are unable to do so themselves for various reasons such as operating costs, technological readiness, the investment period for transition to a low-carbon business, etc.

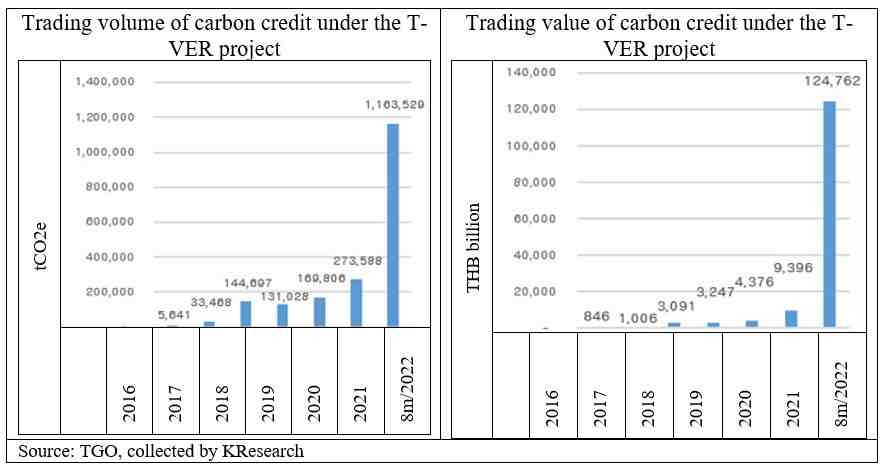

Statistics of Thailand’s carbon credit trading

Carbon credit trading under the T-VER project has continued to grow, increasing from THB0.85 million at the start of the project in 2016 to THB146.7 million as of July 2022, with a total carbon credit trading volume of 1.92 million tons carbon dioxide equivalent (tCO2e), representing an average carbon credit price of THB76.35 per ton. Most of the carbon credit trading value and volume occurred during the first 8 months of 2022, reaching THB124.8 million (an increase of 13 times from 2021), with trading volume of 1.16 million tons at an average price of THB107.23 per ton.

However, compared to 257.77 million tCO2e2 of Thailand’s latest greenhouse gas emissions in 2021, the trading volume of carbon credit under the T-VER project is still low, accounting for 0.1% of total greenhouse gas emissions in 2021 and accounting for 14.2% of total certified carbon credits of 13.5 million tCO2e.

Thailand’s carbon credit market situation becomes an opportunity for the business sector The recent significant increase in the trading value and volume of carbon credits, coupled with the still low trading volume of carbon credits compared to the amount of greenhouse gas emissions generated and certified under the T-VER project, including more concrete goals announced by the business sector in setting greenhouse gas emission targets, reflect the growing trend of businesses to focus on offsetting greenhouse gas emissions and the opportunity to trade carbon credits for compensation of greenhouse gas emissions. At present, Thai businesses are considered to have advantages in terms of offsetting greenhouse gas emissions for the following reasons:

The price of trading carbon credits in the Thai carbon credit market is relatively low compared to the global market, partly because Thailand does not have a policy to enforce the amount of greenhouse gas emissions like other countries such as the EU, the UK, California of the U.S., South Korea, etc. This reflects the fact that businesses and industries with high-costs in acquiring new technology, or Thai businesses wanting to compensate for their greenhouse gas emissions, are able to offset their carbon credits at a lower cost than in other international markets, and leads to the benefit of building a good image in fundraising and to increase the competitiveness of the business in the international market that focuses on reducing its environmental impact.

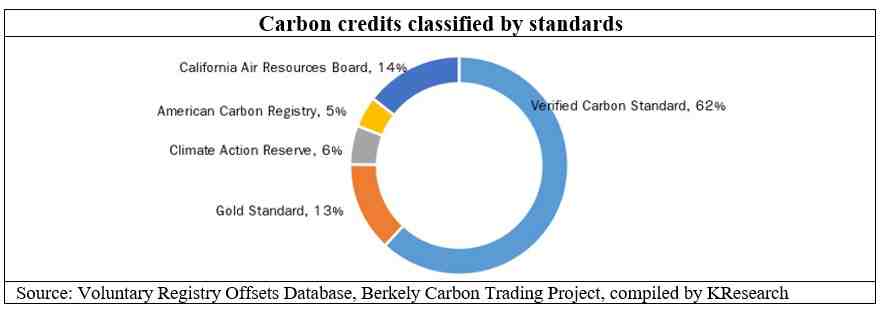

- Thailand’s carbon credit standards are linked to international standards

Previously, carbon credits certified by the T-VER project were the standard that could be used to offset greenhouse gas emissions in Thailand only. However, the Thailand Greenhouse Gas Management Organization (TGO) has currently linked the T-VER carbon credit standard with the Verra’s Verified Carbon Standard (VCS), which is the international voluntary greenhouse gas reduction mechanism with the world’s largest market share. This will enable the carbon credits received from Thailand’s T-VER project to be consistent with and equivalent to international standards and can be traded in foreign countries with the VCS standard. Therefore, the price of carbon credits received from the T-VER project will tend to rise in line with global demand, which is a boon to businesses related to clean energy, renewable energy and carbon dioxide absorption/storage technology. In addition, projects to reduce greenhouse gas emissions implemented under the T-VER project will be rewarded based on higher carbon credit prices, which is another way to drive development of green technology in Thailand.

- Good sentiment in carbon credit market brought by the cooperation of the Thai private sector

Previously, the Thai business sector has come together to exchange information, promote actions to reduce environmental impact, and provide channels for carbon credit trading such as the establishment of the Thailand Climate Change Network (TCCN) and the establishment of the Thai Renewable Energy Association (RE100 Thailand Club), with the aim of creating an environment for the transition to 100% renewable energy. Since Thailand’s carbon credit market mechanism is voluntary, the cooperation from the Thai business sector has played a critical role in helping to develop and boost a trading sentiment in the carbon credit market in the past and preparing Thai businesses for the implementation of future environmental measures related to the greenhouse gas emissions from trading partners.

- Development of carbon credit trading and carbon tracking infrastructure to reduce greenhouse gas emissions

Currently, the Federation of Thai Industries (FTI) has developed a platform for trading clean energy and carbon credits, or the FTIX, to be a trading carbon credit center linked to the TGO’s database, which will facilitate and simplify operations for businesses that formerly had to negotiate prices and volume with businesses that have excess carbon credits in the form of over-the-counter transactions, as well as support the purchase of the Renewable Energy Certificate (REC) of the Electricity Generating Authority of Thailand (EGAT). Meanwhile, the FTI is in the process of testing the ERC Sandbox 2 of Office of the Energy Regulatory Commission (ERC), which is preparing to sell green power (Green Tariff) generated from clean energy production projects to the business sector3 . This will be another factor that encourages businesses to have more flexibility and ease in reducing and tracking their greenhouse gas emissions.

In summary

In the short-term, businesses in transition or those with high investment costs in technologies to reduce greenhouse gas emissions will benefit from Thailand’s low carbon credit price and be able to offset greenhouse gas emissions from their operations at a low cost. In the medium-term, the improvement of Thailand’s carbon credit standard to be equivalent to international standards will be a key factor in boosting demand for Thailand’s carbon credits in the international market. As a result, the price of Thai carbon credits is close to that in the international market, which will help businesses implementing projects that generate carbon credits, such as those related to clean energy, renewable energy, greenhouse gas absorption and storage technology, etc. to get worthy returns on their investments in project development. Moreover, the integration of the private sector to create a trading environment for carbon credits in Thailand and the development of a platform for relevant agencies to become the trading center for carbon credits and the Renewable Energy Certificate (REC) or other environmental certificates in the future, will also facilitate the creation of infrastructure, create good sentiment for carbon credit trading in Thailand in the long run and help Thai businesses achieve their greenhouse gas emission reduction targets.

-----------------------------------------------------------------------

1 Data from TGO (as of May 25, 2022) and SBTi

2 Our World in Data

3 Office of the Energy Regulatory Commission, September 26, 2022

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.