Accidents are events that exceed expectations and are the primary factor that causes most car owners to pay thousands or even tens of thousands of Baht for damage caused by the accidents. Even if you do not expect to have any accidents and have to make claims, you cannot help but feel distressed by such a burden as it seems like a waste of money. Therefore, the primary concern of many car owners who want to insure their cars for peace of mind will be inevitably to buy insurance that is worthwhile or the most economical with maximum benefits. However, choosing to buy insurance is not easy because the conditions for purchasing insurance may vary from person to person, and the coverage terms of each insurance policy are designed to meet group behavior on average. Eventually, value judgments are subjective and may not be consistent with other people’s experiences.

Here, we would like to share three considerations for buying voluntary auto insurance, focusing on class 1 auto insurance that provides coverage for your car and other cars involved in the accident. Due to the high insurance premiums at the rate of over ten thousand Baht, this type of insurance is suitable for new cars, car-enthusiasts and car owners who want to be secured for comprehensive coverage.

First, is it more economical to buy insurance through a broker?

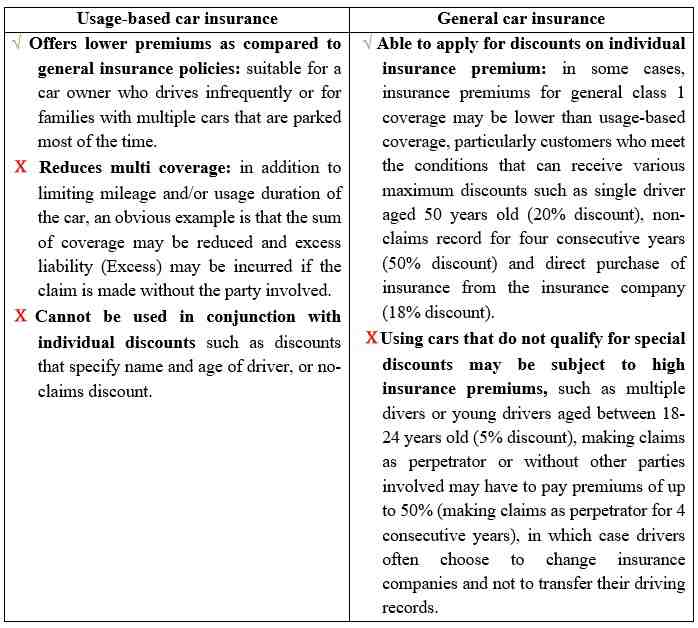

Second, is it more economical to buy limited mileage insurance and/or limited time insurance?

\

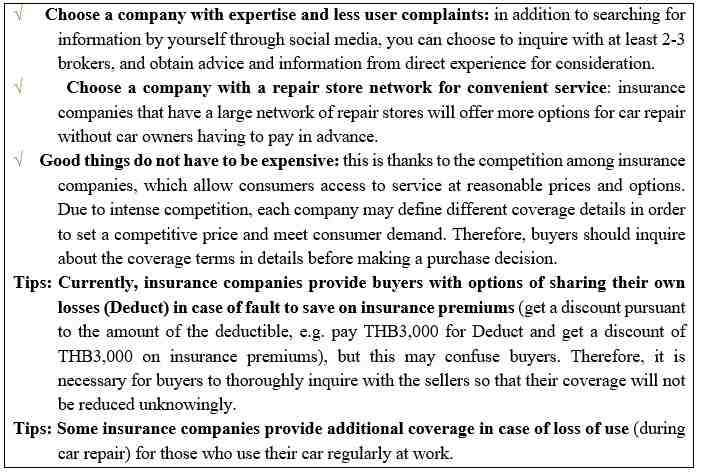

Third, how to choose an insurance company with more confidence?

The premium has already been paid, so you do not have to feel bad when there is a need to make a claim. If you choose a good insurance company carefully, you are likely getting a good and trustworthy partner. Therefore, it is necessary to take insurance company information, and insurance policy that is suitable for own car usage as well as the convenience of after-sales service, especially claims and repairs, into account. However, due to the special situation that the total amount of COVID insurance claims during 2021-2022 jumped to over THB ten billions, the coverage for car insurance of some insurance companies may be affected, resulting in inconvenience for customers in making car insurance claims and possible delay in car repairs. Nonetheless, related parties aim to help the insured obtain the right to coverage according to the contract, even though some insurance companies have closed down, their insurance obligations have been transferred to other insurance companies and remain binding on the insured until the contract expires.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.