Over the past few weeks, the issue of taxation on cryptocurrency investments has been the subject of widespread discussion. Currently, many countries and regions such as the United States, Hong Kong and Singapore have taxed cryptocurrencies. In addition to the issue of fiscal revenue and transaction monitoring, there are considerations of improving fairness in the system due to the fact that investors who invest in financial assets, especially securities and cryptocurrencies, often have different profiles and characteristics than depositors, whether in terms of education, knowledge, risk tolerance, and possibly better financial status.

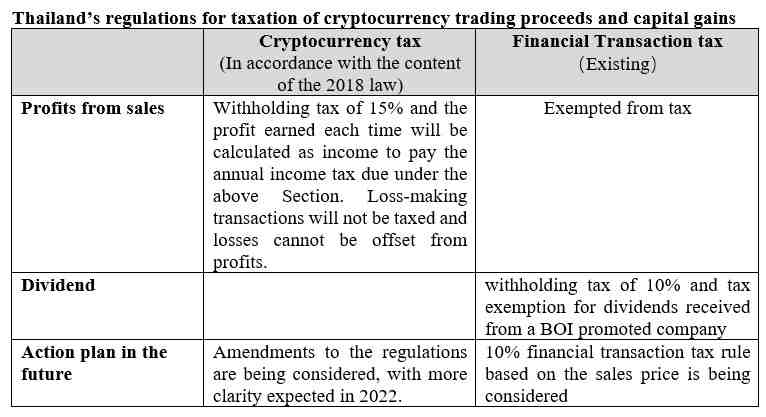

For Thailand, investors who are primarily the sellers of cryptocurrencies must treat the profit earned from each transaction, i.e. the benefit received from transfer of cryptocurrencies or digital tokens, as a financial transaction under Section 40 (4)(Chor.) of the Revenue Code and pay income tax. At the same time, cryptocurrency buyers who are payers must withhold 15% of the profits of cryptocurrency sellers as withholding tax. This means that if an investor makes a profit from each cryptocurrency sale, he/she must pay the tax twice, i.e. being deducted 15% of withholding tax, and the profit earned each time will be calculated as income to pay annual income tax due under the above Section. Loss-making transactions will not be taxed, and losses cannot be offset from profits.

KResearch has the following additional views:

- In fact, Thailand has enacted and implemented a law to tax cryptocurrency investment transactions since 2018, with the aim of expanding a new tax base, while also studying other ways to expand the tax base, but at that time the volume of cryptocurrency trading in Thailand remained low. However, during 2020 – 2021 the cryptocurrency market in Thailand has been very active as cryptocurrency prices rose. The number of digital asset investor accounts1 has jumped to 1,979,847 in November 2021 from 10,000 at the beginning of the year, showing that a large number of new investors have entered the market. At a time when the cryptocurrency tax is still new to investors, it is therefore important and necessary to clarify the rules for paying taxes and continuously promote such legal compliance to create investor’s understanding of common practice.

However, the Revenue Department is now open to receiving opinions of interested parties, regarding the limitations or difficulties in the implementation of the cryptocurrency taxation guidelines. For example, without a good record of transactions, a cryptocurrency buyer may have no way of knowing the profits made by the seller, especially from mining cryptocurrencies, and therefore cannot make withholding tax on the seller’s profits. Currently, the Digital Asset Exchanges still has limitations on withholding taxes and in collecting and sending it to the Revenue Department. The working group is still working on finding solutions, and more definitive guidelines are expected by January 2022.

- Studies of the principle of foreign cryptocurrency taxation regulations show that different countries have different taxation manners for investment in cryptocurrencies, depending on the necessity for financial status, the direction of the government’s new financial asset market development and the readiness of investors in the country. Some countries such as Switzerland and Portugal offer tax exemptions for cryptocurrency investment activities, while countries/regions such as Hong Kong and Singapore offer tax exemptions for long-term cryptocurrency investments. The United States, on the other hand, taxes cryptocurrency investment at the same rate as other financial securities such as stocks, with long-term investments taxed at 0–20% and short-term investments taxed at 10-37%, and also allows losses to be deducted from the taxable income in the event that there is no income from securities sales. However, currently the governments of many countries including the United States are collecting crypto-related transaction data, so the above taxation guidelines and other regulatory measures may change in the future.

However, cryptocurrencies are a highly volatile new asset that is often used as a vehicle for illegal activities. Most investors still lack sufficient knowledge of cryptocurrencies, resulting in a market where most investors are seeking short-term speculative gains and may be tricked into making illegal investments. At the same time, such short-term speculation behavior does not support operators to develop new innovations that are more beneficial in the long run, thus making the authorities in many countries, including Thailand, to be concerned about the potential damage to investors and the overall financial asset market. The level of investors’ understanding and knowledge of cryptocurrencies remains a major concern for the authorities, and should be used as one of the guidelines for formulating investment regulatory guidelines in the future.

For Thailand, a survey by KResearch showed that more than 50% of Thai investors who invested in cryptocurrencies have assessed their knowledge of cryptocurrencies to be only moderate, about 18.2% of investors said the main reason for investing in cryptocurrencies is because they believed prices will continue to rise and expected high returns, and around 43%, intended to prioritize increasing their investment in cryptocurrencies in 2022. This reflects the fact that the majority of Thai investors remain optimistic about investing in the cryptocurrency market, despite their low level of knowledge about it. Therefore, the future direction of the regulatory rules for the cryptocurrency market and the taxation regulations still need to take into account the investment level of investors as well. The more important question is how the overall rules can facilitate the asset market developments or achieve better results in terms of new innovations, and in the future be appropriate with investor readiness and changing economic conditions.

-------------------------------------------------------------------------------

1 Source: The Securities and Exchange Commission

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.