In general, cryptocurrencies are typically used for two main purposes: 1) as an alternative asset for investment, and 2) as a medium for the exchange of goods and services as well as the trading of other assets such as NFT (Non-Fungible Token). In particular, the global trend of investment in cryptocurrencies is on the rise over the past 1-2 years, resulting in more operators in various business sectors across the world to start accepting payments for goods and services in cryptocurrencies.

Thailand’s cryptocurrency market is moving in line with the global cryptocurrency market, as reflected by the number of investor accounts in the Thai digital asset market growing to 2.59 million accounts in February 2022, which is more than 5 times from the same period of 2021. While several major business operators in Thailand such as real estate and retail operators plan to accept payments for goods and services in cryptocurrencies, sellers and buyers of goods and services must bear the risk for using cryptocurrencies, which are not recognized as legal settlement currencies in countries around the world, except El Salvador, which has become the first and only country in the world that currently has an explicit law recognizing Bitcoin as a legal settlement currency. In addition, buyers and sellers of goods and services are exposed to the risk of price fluctuations, which is the main reason why cryptocurrencies lack the quality of a good store of value and measure of value.

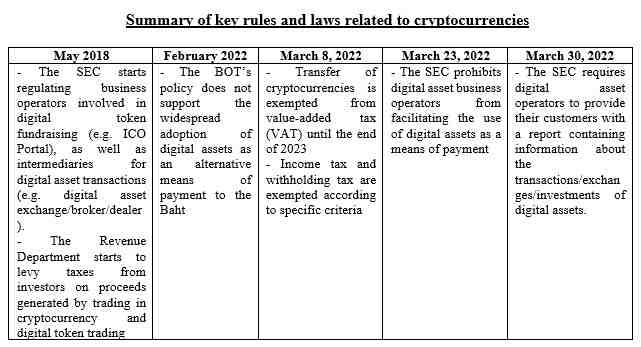

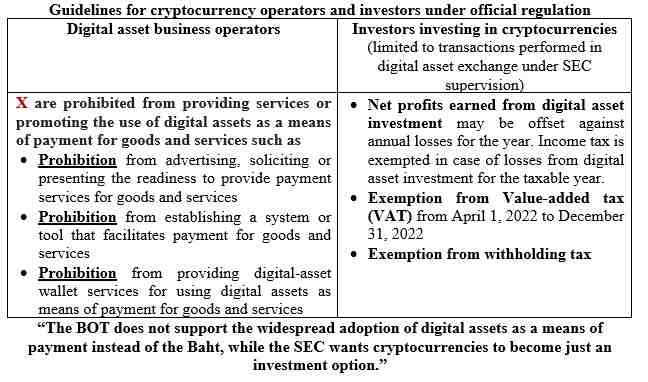

The Bank of Thailand (BOT) has a clear policy of not supporting the widespread adoption of any digital assets including private sector digital currencies for payment of goods and services (Means of Payment) instead of the Baht, while the Securities and Exchange Commission (SEC) wants cryptocurrencies to become just an investment option. This means that businesses that want to connect their products and services with digital assets will have to review their business plans in accordance with official policy direction. Meanwhile, digital asset business operators, especially digital asset exchange, must create additional systems to support the digital asset trading, exchange and investment reporting, as well as customer transaction data storage for the investor’s annual tax filing and the VAT deduction system, which would cause higher investment costs. Investors should also follow the official investment-related rules, as the rapid change in technology will lead to rapid change in innovations in digital assets and digital currencies. Given this, change may occur from both the user’s side and the officials’ side, thus regulatory guidelines need to be revised periodically to suit the environmental factors. Nonetheless, a pilot testing of a digital currency developed by the BOT for daily use will soon be available.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.