Over the past few years, the food delivery market has grown exponentially due to multiple supporting factors from both the supply side and demand side, namely:

-

The emergence of multiple waves of COVID-19 outbreaks from 2020 to the first half of 2022 has driven consumers to change their behavior to accommodate the restrictions on living and working. Meanwhile, business operators in the supply

chain, including online food delivery platforms and large restaurant operators, have entered the market to generate income and continue to launch various promotions such as delivery fee exemption/reduction, etc.

-

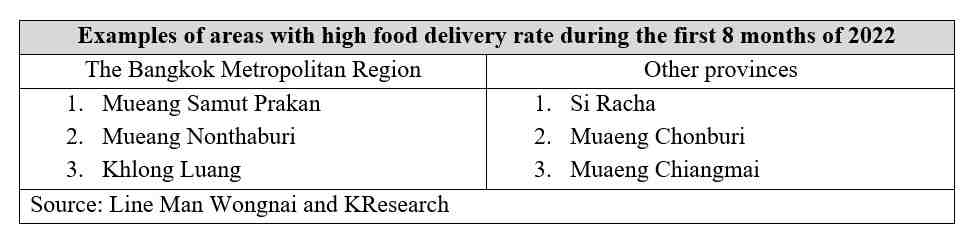

The food delivery platforms have expanded their services to cover more areas in various provinces across the country, particularly in the economic provinces like Chonburi, Chiang Mai, Khon Kaen and Phitsanulok. This factor has significantly contributed to the market’s growth.

-

The privileges of the government’s Half-Half Co-Payment scheme can be used on food delivery platforms from the end of 2021 (The food delivery platforms joined the phase 3 Half-Half Co-Payment scheme on October 4, 2021).

-

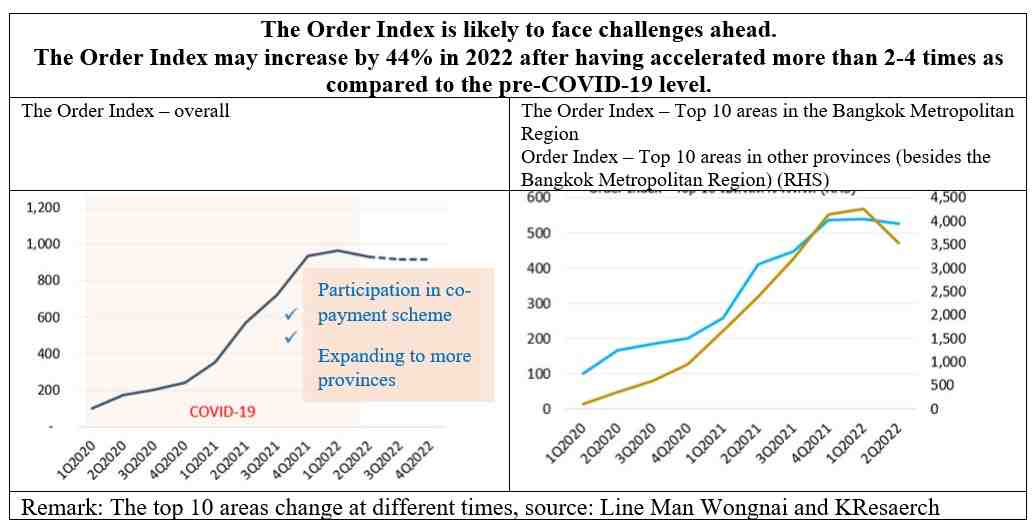

The above growth of the food delivery business is reflected in Line Man Wongnai’s index gauging food delivery orders (Order index), which grew by more than 2-4 times during 2020-2021 as compared to the pre-COVID-19 epidemic or before 2019. However, it is worth mentioning that the Order Index is starting to show signs of slowing down in 2022, although the first 8-month average still rose by 76% YoY. The Order Index also shows a slowdown in the 10 areas with the highest service usage in the Bangkok Metropolitan Region and other provinces.

KResearch views that with the COVID-19 situation easing, the food delivery market is likely to face more challenges going forward, as consumers have changed their behavior back to more outdoor activities and the growth of the Order Index will be limited. This is not too different from other online businesses such as e-commerce, which gained tremendous momentum during the COVID-19 pandemic, but as the COVID-19 situation eased, the growth rate started to slow down. Preliminarily, KResearch projects that for the remainder of 2022, the Order Index may shrink year-on-year, partly due to a high base in the previous year. As a result, the Order Index may increase by 44% in 2022.

However, when analyzing data by areas, the Order Index in the top 10 areas with the highest service usage in the Bangkok Metropolitan Region, such as Mueang Nonthaburi, Mueang Samut Prakan and Khlong Luang, is relatively stable or has dropped at a slower rate than other areas. This may partially reflect the behavior of consumers who live in densely populated areas, where consumers who work from home still choose to use convenience-focused food delivery services, which is in line with the modern lifestyle and working styles.

The aforesaid information should be one of the many tools that the business operators use to analyze in order to adjust their business strategies in the future, including platform’s resource allocation and investment, such as traffic/rider management, promotion campaign design, sponsorship of restaurants on the platform, etc. As for restaurants, although maintaining overall Order Index has become more difficult, online sales channel remains necessary in the face of challenges of competition and rising costs including labor, raw materials and fuel cost.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.