At present, many countries worldwide are transitioning to a less cash, or even a cashless society. Evidently, more consumers in foreign countries prefer e-payment that can be made via debit card, credit card, internet banking, mobile banking or e-wallet. However, the present level of cashless payment varies from country to country. According to a study of Thomas (2013), the transition to a cashless society can be divided into four stages based on the share of cashless payment. They are, i.e., 1) inception; 2) transitioning; 3) tipping point; and 4) advanced.

Most developing countries are now in the first stage or the inception of a cashless society. By and large, more than 90 percent of financial transactions are cash-based. This is because access to cashless payment technology – a key infrastructure for ‘going cashless’ – is still far from full coverage among consumer groups. This situation can be seen in Indonesia, Taiwan, Thailand, Peru and Malaysia, among others. Meanwhile, almost all consumers in the countries which are in the fourth or advanced stage of a cashless society rely on cashless transactions. Basically, they use a debit or credit card when it comes to payment for goods and services. At the same time, debit card payment points can be found almost everywhere. Countries in the advanced stage of a cashless society include Singapore, Canada, Sweden and the Netherlands.

Broadly speaking, the emergence of a cashless society can be attributed to three major elements as follows:

-

Consumers’ preference for e-payment – During the era of COVID-19 which began in early 2020, most consumers avoided handling cash as the pandemic fanned public concerns that the coronavirus could be transmitted by cash. More and more people have come to rely on contactless payment1 in lieu of cash in their daily lives. For instance, consumers have shifted to smart cards, in the form of contactless credit and debit cards, as well as online payment methods such as mobile banking and e-wallet. What’s more, they are buying food, products and services via online platforms, especially online food delivery service and e-marketplace. Amid the changing consumer behavior, online payments have increased substantially.

-

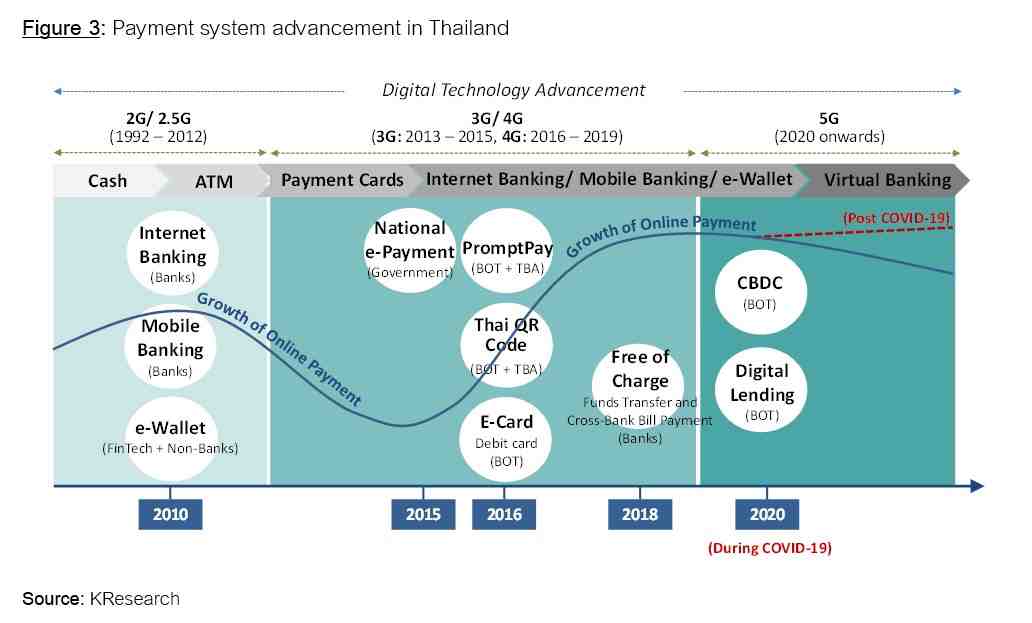

Advancement of Digital Technologies – Wireless high-speed internet or 4G and 5G mobile internet, as well as technologies used with communications devices, are part of an important infrastructure to accommodate the development of contactless payment. Given service providers’ expansion of electronic or contactless payment service points to cover all service areas, and continuous development of payment systems, for example, payment functions on mobile banking or e-wallet to be compatible with both QR code and barcode scanning, consumers will enjoy user-friendly and convenient services, leading to a surge in service usage. In addition, such developments will play a crucial role in changing consumers’ behavior with regard to payments for goods and services.

-

Government policy to promote a cashless society – Such government policy is key to promote more cashless payment for goods and services in Thailand. Aside from the infrastructural development and support of the private sector, in particular domestic service providers, the banking industry and consumers, government support and cooperation of service providers are essential to the emergence of a cashless society in Thailand.

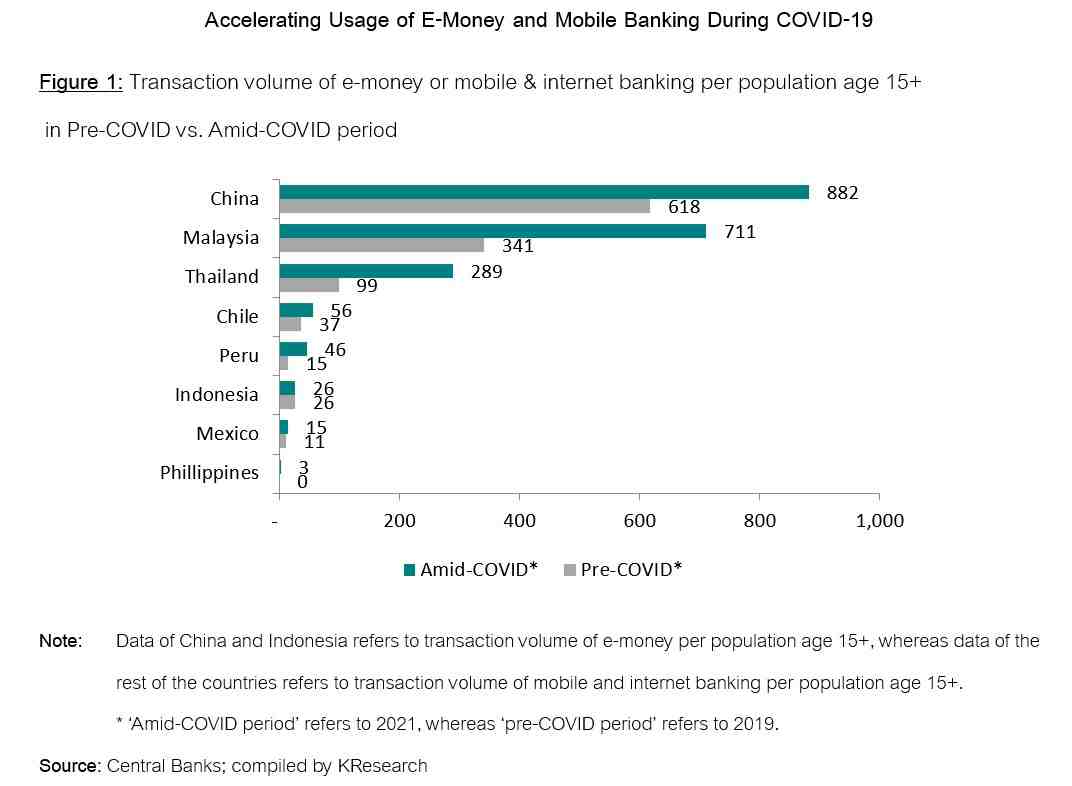

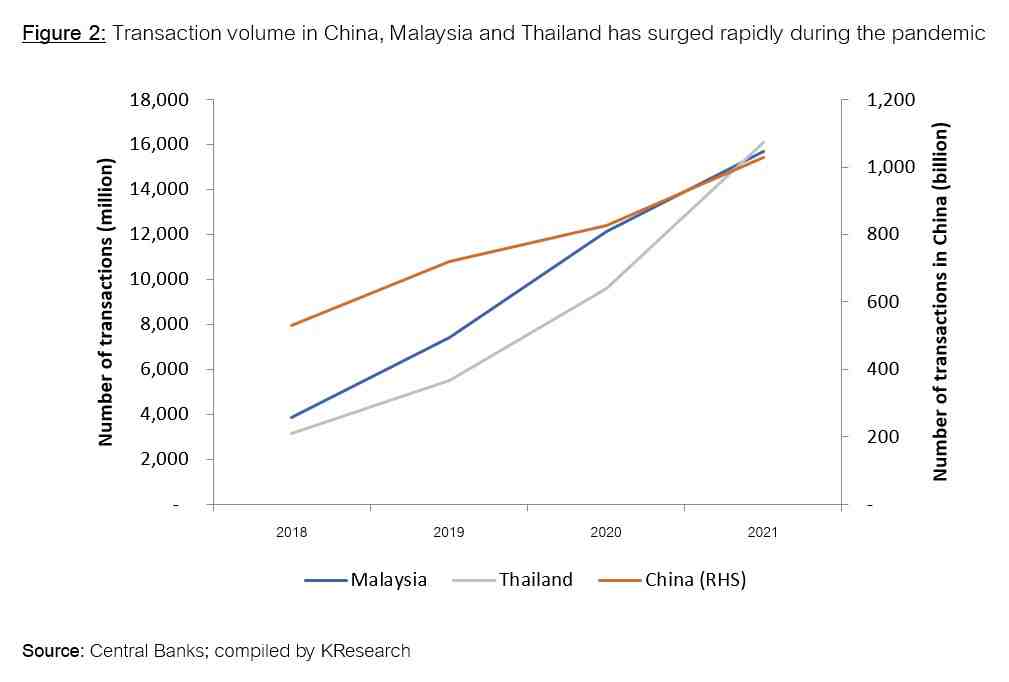

Cashless payments in the Asia-Pacific Economic Cooperation (APEC) bloc have risen substantially, as seen from online payments for goods and services in developing nations, such as China, Malaysia and Thailand (Figures 1 and 2). The COVID-19 pandemic could be considered a game changer for consumer behaviors in many countries, which has in turn ushered in the abovementioned cashless society, as evidenced by sharp increases in transactions via mobile banking, internet banking and e-wallet. Such a situation has also led to greater financial inclusion on the domestic front.

The expansion of financial transactions through mobile banking, internet banking, and e-wallet reflects increased competition among domestic payment service providers, including banks and non-banks that aim to induce consumers to more often use such technology. It also reflects government policy of supporting and promoting competition in the market. Concurrently, the Asia-Pacific Economic Cooperation (APEC) Leaders’ Summit 2020, hosted by Malaysia, also recommended that member states promote cashless payments via e-wallet2.

For Thailand, advancements in digital technology along with changing behavior of domestic consumers towards conducting more financial transactions through digital channels instead of bank branches, and unrelenting market competition, have prompted financial service providers to accelerate the development of applications (apps) for the provision of payment services via mobile banking and e-wallet, with emphasis placed on the development of user-friendly apps for consumers of all ages. Additionally, due to the intense competition, financial service providers have had to introduce promotions such as discounts on foods, products and services as part of their marketing strategy for payments made through mobile banking or e-wallet during the initial phase, helping boost spending via online channels in the country.

Concurrently, the government has steadily supported and promoted a cashless society since 2015 under the National e-Payment Master Plan through four main projects: 1) Any ID payment; 2) expansion of the use of electronic cards; 3) development of the e-tax invoice system; and 4) government e-payment.

Presently, projects under the National e-Payment Master Plan have progressed in many areas, and several of these projects have proven quite successful, namely Any ID payment such as PromptPay, because it allows consumers and businesses to transfer funds via mobile phone number, National ID card number or juristic person registration number more conveniently, quickly and at lower costs. As of June 2022, the number of accounts registered for PromptPay totaled 71 million, and the number of daily funds transfers reached approximately 38.7 million on average, an increase of roughly 59.3 percent YoY or equivalent to approximately 121.4 billion Baht, an increase of around 37.6 percent YoY. Additionally, the PromptPay system has been developed to offer new services such as cross-bank bill payment and Thai QR code payment, resulting in more cashless spending or payments among Thai consumers.

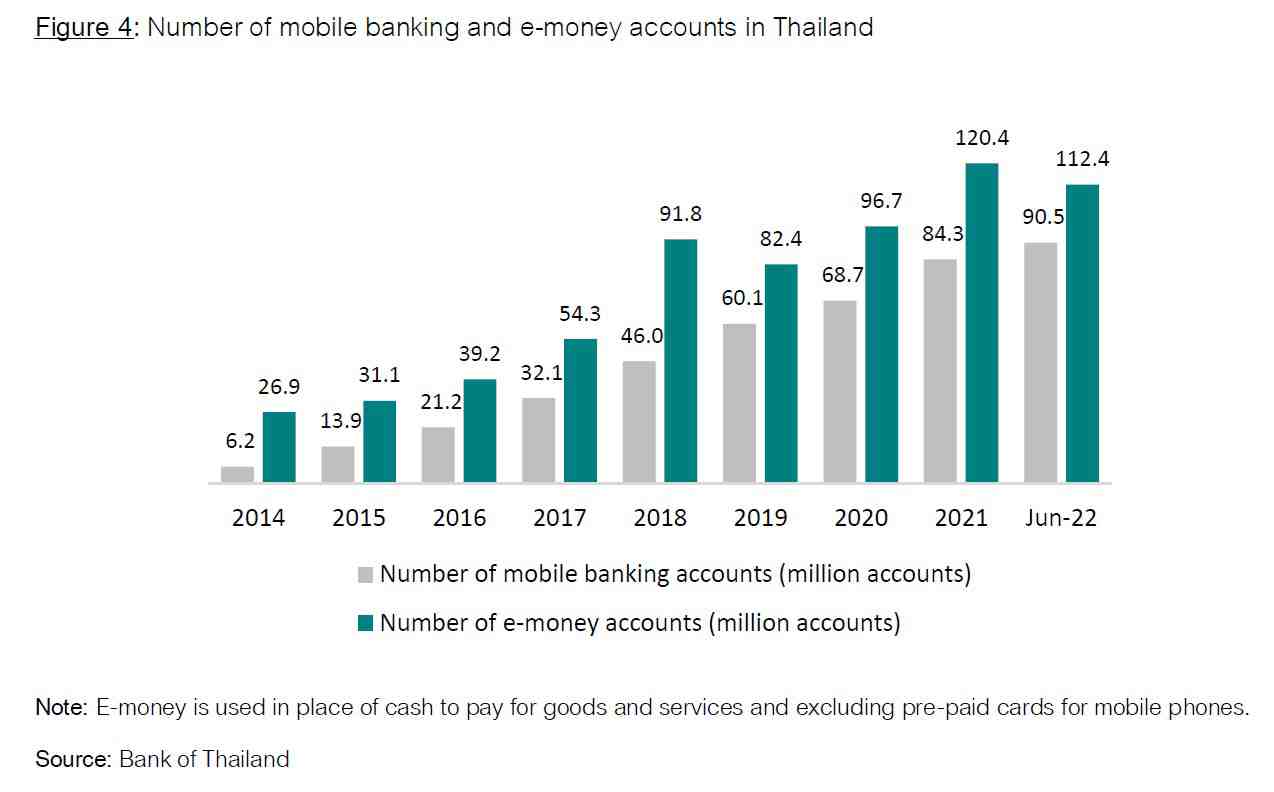

The COVID-19 outbreak has also proved to be a catalyst for the growth of cashless payment transactions. As evidenced, the number of mobile banking and e-money accounts increased during 2020-2021. Meanwhile, the government has introduced an electronic wallet (G-Wallet) like the Pao Tang app to provide financial aid to people affected by COVID-19, including economic stimulus measures such as the “Kon La Krueng" co-payment scheme, “Rao Chana" (We Win) cash handout scheme, "Rao Tiew Duay Kan'" (We Travel Together) tourism stimulus campaign, etc. As of June 2022, the app has over 34 million users, having been registered by around 61 percent of the eligible population aged 15 or older. This has been key in encouraging most Thai consumers to become more familiar with cashless payment for goods and services.

In summary, the transition to a cashless society will continue in several countries, including Thailand, over the next 1-3 years. This will become even more apparent if many countries officially launch their own central bank digital currencies (CBDCs). In fact, APEC member economies that are developing and conducting pilot tests of CBDC include Canada, Japan, China, Singapore, Thailand, Indonesia, Hong Kong, South Korea, etc.

In Thailand, the Bank of Thailand (BOT) has initiated a Wholesale CBDC project to develop and test functionalities to support both domestic and cross-border funds transfers. The testing has been conducted in collaboration with the Hong Kong Monetary Authority, the Central Bank of the United Arab Emirates, and the Digital Currency Institute of the People's Bank of China. Additionally, the scope of testing has been expanded to the private sector by integration with the B2P platform, which is a procurement system. Meanwhile, the BOT is also exploring and testing Retail CBDC for the general public. Moreover, the BOT, in cooperation with the business sector, has completed the CBDC proof-of-concept and is going to expand the scope of study and development of Retail CBDC through pilot tests in cooperation with the private sector in 2022.

The move towards a cashless society as well as CBDC development are expected to reduce costs of the business sector and improve financial inclusion of the general public, while also helping the target groups to benefit from economic stimulus campaigns more substantially and with greater accuracy. This is considered a new dimension of the financial industry and is likely to promote inclusive and sustainable growth in the digital economy of the future. Focus would also be on innovative development and awareness of associated risks, including enhancement of public financial and digital literacy.

1. Contactless payment’ per the broad definition includes transactions via communication devices that are compatible with radio frequency identification (RFID) or near-field communication (NFC) technologies and payment via online channels such as internet banking, mobile banking and e-wallet.

2. Source: https://bebasnews.my/2019/03/21/apec-2020-aspires-to-use-cashless-payment/

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.