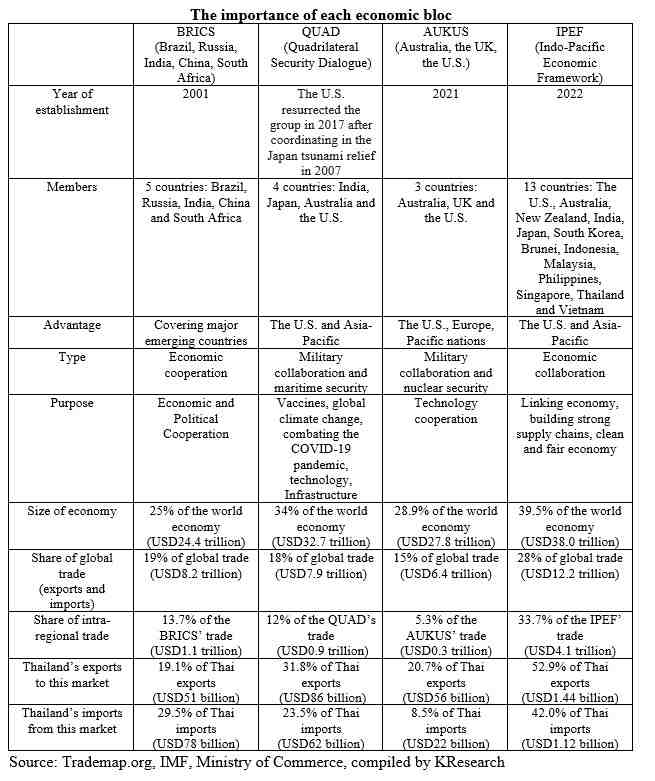

BRICS is an economic bloc of emerging countries consisting of Brazil, Russia, India, China and South Africa, which exists as a non-free trade area, and therefore has no obligation to open markets for trade and investment. At present, there are numerous cooperation frameworks of this nature that are the result of geopolitical conflicts. The U.S., as the leader, has been pushing economic blocs to establish military and technological security alliances like QUAD (Quadrilateral Security Dialogue) and AUKUS (Australia, United Kingdom, United States). Recently, the U.S. has initiated the IPEF (Indo-Pacific Economic Framework for Prosperity) in May 2022 to focus on economic cooperation.

Among the above-mentioned economic blocs, the IPEF is attractive in many ways. Its economic size is 39.5% of the world’s economy, larger than the RCEP (Regional Comprehensive Economic Partnership) framework that currently is the world’s largest FTA. As for the IPEF’s role in global trade, it accounts for 28% of global trade, similar to that of the RCEP. With regard to intra-regional trade, the IPEF relies on such trade as much as 33.7%, unlike other economic groups, which, despite their similar importance in the world economy, have a small share of intra-regional trade, i.e. 13.7% for the BRICS, 12% for the QUAD and 5.3% for the AUKUS.

As for the annual BRICS summit on June 23-24, 2022, the main topic of focus is the push led by China and Russia to use local currency instead of the U.S. dollar, which is a new dimension for such an annual summit that mainly focuses on strengthening economic, trade and investment ties. The concept of using local currency payments is a consequence of the Russia-Ukraine war, which has led to international sanctions to remove Russia from the SWIFT financial system and could last for a long time, thus the issue of payment has become an important topic in this BRICS summit.

International payment has become a new focus, and there may be more interesting developments from now on. Since the past, the use of the Russian payment system or Sistema Peredachi Finansovykh Soobscheniy (SPFS) was limited to some European countries of the Commonwealth of Independent States (CIS), China and India, mainly for the purchase of Russian goods. The Ruble, meanwhile, has a small share of usage of only 0.21%, ranking 20th of the most used currencies in the world. So far, the U.S. dollar remains the most important currency for international payments with a share of 40.51%, followed by the Euro with a share of 36.65% and the Pound Sterling with a share of 5.89% (data from SWIFT in 2021). Among the currencies of BRICS member countries, only the RMB stands out relatively, ranking fourth as the most active currency for global payments with a share of 2.7%, driven by the efforts of the Chinese government for more than a decade and the BRI (Belt and Road Initiative), which has helped boost the widespread use of the RMB. The South African Rand is ranked in 17th place with a share of 0.28%. However, looking ahead, we will see more of Russia’s trade partners shift to using the Ruble to pay for Russia goods. Recently, Egypt and Russia have agreed to switch to payment in local currencies (Egyptian Pound and Russian Ruble) in their trade transactions to solve the payment problems in the U.S. dollar, as Egypt is the world’s largest wheat importer and relies heavily on Russian wheat.

It can be seen that international geopolitical issues have become one of the tools in driving the direction of each economic group. For example, the IPEF, of which Thailand has been invited to become a member, should be able to have a positive impact on Thailand’s co-development with the IPEF, which is an important export market of Thailand with a share of 52.9%, if any concrete plans are agreed upon. While the integration of other groups is unconditional and Thailand is not a member of them, the overall trade between Thailand and each economic group will not change much from the current situation. However, it is important to monitor the movement of each economic group, which will affect the strategic direction of business in each region of the world in the midst of intensified geopolitics.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.