The Financial Institutions Development Fund (FIDF) of Thailand has played an increasingly prominent role since Thailand’s financial crisis in 1997, as it issued FIDF1, FIDF2 and FIDF3 bonds totaling THB1.4 trillion between 1998-2002 to help mitigate the direct and indirect burdens associated with bad debts, compensate for losses due to the closure of financial institutions with liquidity problems, increase the capital of financial institutions, and curb systemic risks, as well as help the financial sector function as a lending mechanism and continue to boost Thai economic development. However, this has come at the cost that various sectors such as government agencies, the Bank of Thailand and financial institutions must make contributions to repay the debts. As for the financial institutions that are still operating, contributions must be calculated at the rate prescribed by law based on their deposits, making the contributions to the Thai financial institutions by Thai financial institutions for 2018-2019 (before reducing the contribution rate to the Financial Institutions Development Fund) not less than THB60 billion per year, which is equivalent to reducing the financial burden of the country.

As of October 2022, the debt burden of the Financial Institutions Development Fund (FIDF1 and FIDF3) remains at about THB670 billion, representing approximately 3.9% of Thailand’s gross domestic product (GDP) and 6.4% of total public debt. The allocation of responsible parties and related procedures for debt repayment have been refined several times over the past 20 years to align the methods and sources of funding for repaying debts with the capacity of the responsible parties in each era.

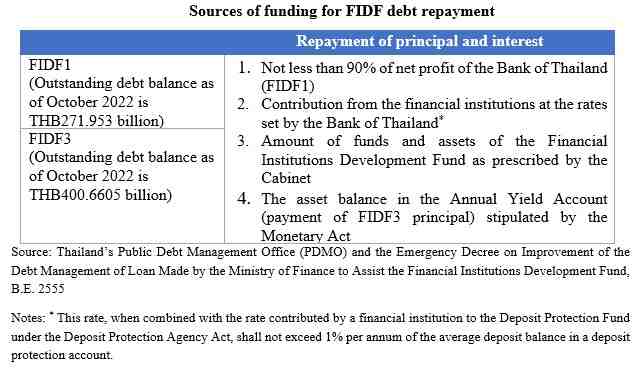

Currently, the allocation of debt repayment has been set out in the Emergency Decree on Improvement of Debt Management of Loan made by the Ministry of Finance to assist the Financial Institutions Development Fund, B.E. 2555 (2012), in which the Financial Institutions Development Fund is responsible for repaying the debts of FIDF1 and FIDF3 as follows:

- Although the reduction of the contribution rate to the Financial Institutions Development Fund from 0.46% to 0.23% during the 2020-2022 COVID-19 pandemic should have reduced the income of the Financial Institutions Development Fund by about THB108 billion, it is also a necessary measure to help debtors catch their breath by helping financial institutions that are facing higher-than-normal provisioning for bad debts, which is in line with the combined amount of non-performing debt and debt under the financial assistance measures increasing to 31% of total loans in June 2020.

- A return to the original contribution rate of 0.46% to the Financial Institution Development Fund will help Thailand repay its entire debt to the Financial Institution Development Fund on schedule, and subsequently use the remaining resources to develop the stability of Thailand’s financial system and economy.

An analysis of the sources of funding for the FIDF debt repayment reveals that early or delayed debt repayment depends on economic and financial conditions in addition to officially prescribed contribution rates, especially on the interest rates and exchange rates that affect earnings in Thai Baht in the Currency Reserve Account of the Currency Issue Department of the Bank of Thailand; the earnings of which will be credited to the annual earnings account that can be used to repay the FIDF debts. It also depends on the growth of deposits affecting the rate of contribution of financial institutions to the Financial Institution Development Fund, as it is the main source of income to repay the FIDF debts. At the same time, the net profit of the Bank of Thailand has fluctuated widely, and given its role in stabilizing the market, it has tended to experience more losses than gains over the past decade (except for 2021, which was profitable, when exchange rate losses were reduced due to the depreciation of the Thai baht), so it may not be possible to pin the reduction of the FIDF debt solely on that source of funding.

KResearch estimates that under the uncertain economic situation, the FIDF debts will decrease at the same rate as in the previous 5-10 years, resulting in a delay of approximately 2 years to 2034 for debt scheduled to be paid off in 2031 (information from the Thailand Public Debt Management Office in 2012). However, if the economic situation returns to normal and future deposits in the financial institutions grow at an average rate of about 5%, it is expected that the FIFD debts will be paid off as scheduled by 2031, which means that Thailand will be able to pay off this historical debt in the next 8-11 years. In both of the above two scenarios, the net profit distribution used by the Bank of Thailand to repay has not been taken into account, and the debt may be paid off sooner than estimates if additional sources of funds are available.

Once the FIDF debts are fully repaid, it is expected that the government will then have the option of either shifting the contribution rate to the FIDF to an increase in the contribution rate to the Deposit Protection Agency, or reducing the contribution rate to the FIDF to reduce costs passed on to customers, especially credit customers. All of these are expected to allocate tens of billions of Baht annually, contributing to the future stability of Thailand’s financial and economic sectors.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.