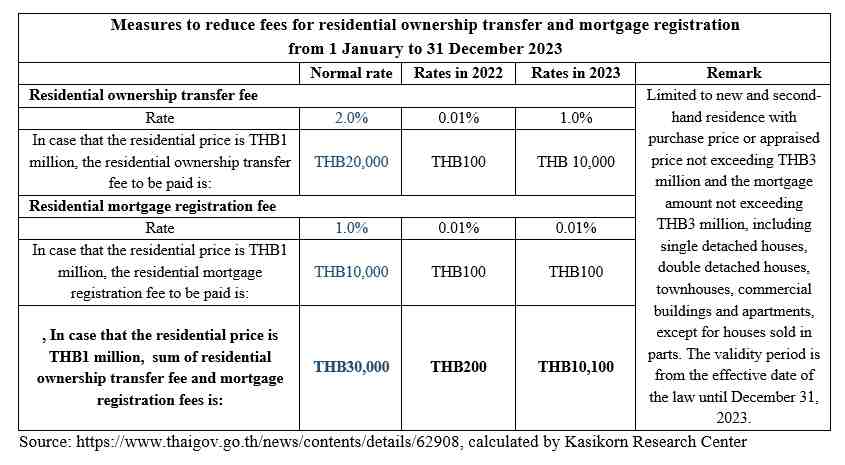

The government has renewed the reduction in fees for residential ownership transfer and mortgage registration, which continues to reduce the rates compared to the normal rate, but the reduction in certain rates is lower as compared to 2022.

After the authorities did not renew the measures to raise the loan-to-value (LTV) ratio cap to 100% for second or more homes, the market is waiting to follow the progress of the renewal of the measures of the residential market transaction fee waiver. On December 20, 2022, the Thai cabinet approved the extension of the reduction in fees for new and second-hand residence with purchase price and appraisal price not exceeding THB3 million and mortgage amount not exceeding THB3 million for another year (from 1 January – 31 December 2023)

However, the details of the reduction in fees have changed from 2022, i.e. the residential mortgage registration fees remain the same as in 2022 at 0.01% (the normal rate is 1.0%), while the residential ownership transfer fee rate has been increased from 0.01% to 1.0% of the purchase price or appraisal price in 2022 (the normal rate is 2.0%).

Kasikorn Research Center views that measures to reduce residential transaction fees have played a role in the residential market in the past, because the price level of residential units not exceeding THB3 million per unit is the price level group with high demand, most of which are condominiums and townhouses, so the renewal of such measures will remain one of the factors that support the future development of the residential market. Although residential transferees will have more expenses than in 2022, the additional cost per transaction per residential unit will not exceed THB29,700, and the residential developers can still use this measure for marketing purposes. Residential units priced below THB3 million are still available for sale, accounting for approximately 53.3% of accumulated residential units for sale in Bangkok and its vicinity areas (AREA data as of the end of June 2022), especially condominiums and townhouses, which are mostly scattered in locations where there is demand for purchase.

However, the Thai residential market still faces multiple pressures in 2023, such as the ability of consumers to purchase a residence is still facing the challenge of a highly uncertain income recovery, consumer purchasing power is still weak due to living expenses and debt burden, the price of a new residence will rise with various costs, and the upward trend of interest rates will increase the installment repayment burden of residential buyers. Therefore, Kasikorn Research Center predicts that the residential ownership transfer in Bangkok and its vicinity areas will be approximately 176,000-184,000 units in 2023, a contraction of about 2.6%-6.9% year-on-year, which is less than the expected growth rate of 12.9% in 2022.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.