On November 29, 2022, the cabinet adopted a resolution to impose a financial transaction tax on securities at a rate of 0.11% (including 0.01% of local tax) of the transaction value. After the above resolution is published in the Royal Gazette, such tax will be levied at a rate of 0.055% (including 0.005% of local levied tax) of the transaction value during the trial period from the second quarter of 2023 to December 31, 2023, and at the normal rate from January 1, 2024 onwards. The financial transaction tax is a specific business tax under the Revenue Code Amendment Act (No. 30) B.E. 2534 (1991) but has been waived since 1992.

However, the tax will be exempted for some categories of transactions, including savings mutual funds and pension funds, and market makers such as social security funds, provident funds, government pension funds, welfare funds (under the Private School Act), retirement mutual funds like RMF, National Savings Fund, mutual funds established under the Securities and Exchange Act to sell investment units to the Social Security Office, as well as market makers registered with the Stock Exchange of Thailand, but only for the sale of securities under the Securities Exchange of Thailand Act where that person is registered as a market maker of such securities.

An analysis of the transaction (buying and selling) taxes of the Stock Exchange of Thailand reveals that there are currently two main types of levies: 1) Dividend withholding tax at a rate of 10% (investment in companies promoted by the Board of Investment (BOI) are exempted); and 2) Capital gain tax: corporate investors have to include the gains as their income for corporate income tax deduction, while retail investors are exempted.

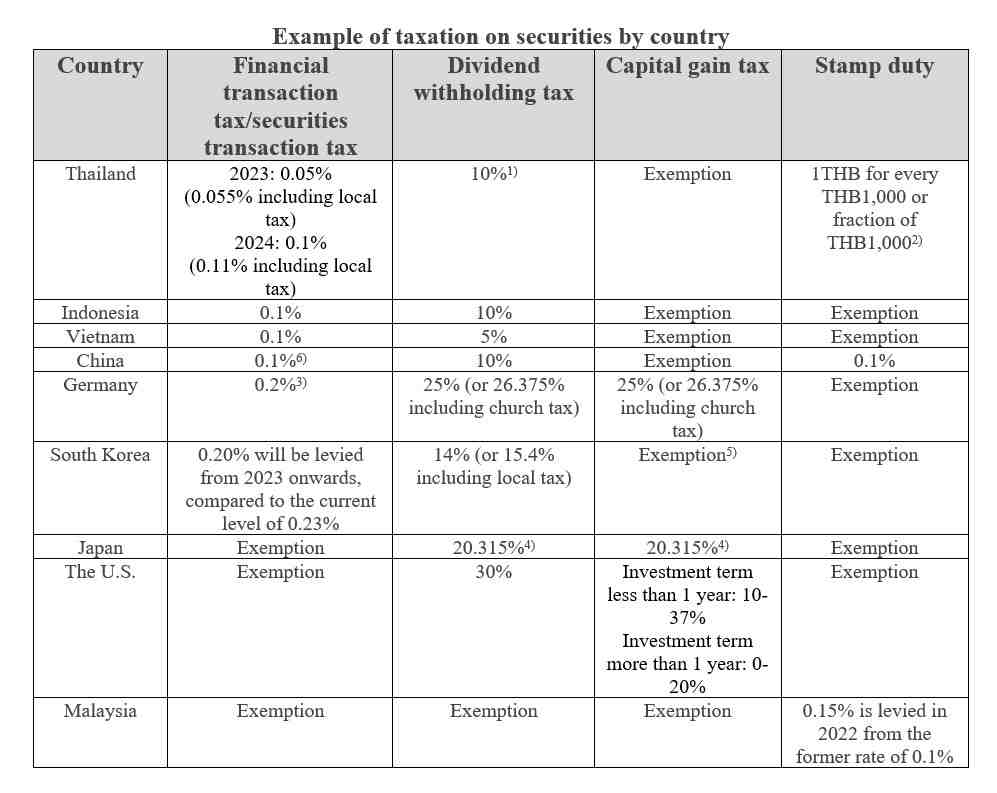

As for the taxation on transactions in foreign stock markets, it is worth to mention that developed markets like the U.S., Germany and Japan impose both a dividend tax and a capital gain tax in securities exchange at relatively high rates, while South Korea currently exempts capital gain tax but is planning to levy it in 2025 at a higher rate of 20-25%. Emerging markets levy lower rates of tax on dividends and capital gains in securities transactions as compared to developed markets, and most emerging countries including China, Malaysia, Indonesia, Vietnam and Thailand exempt capital gain tax, while some countries like Malaysia have also exempted dividend tax and levy only stamp duty.

As for the financial transaction tax/securities transaction tax, it is noticed that some developed markets such as the U.S. and Japan exempt this type of tax, while some emerging markets such as Indonesia and Vietnam may impose such a tax. The different taxation methods and tax rates depends on the government’s policy to create fairness and control or prevent abnormal transactions, as well as the structure of the economy, finance, capital market, investor and fiscal policy of each country.

Remarks:

1) Tax is exempted for dividends received from investment in companies promoted by the BOI.

2) In case of transfer of share certificate, tax is calculated on the paid-up share price (whichever amount is greater), except for the transfer of securities in the securities exchange where TSD is the registrar.

3) In case of purchase of shares in a large company worth more than EUR1 billion.

4) 15.315% of national tax and 5% of local inhabitant’s tax

5) The South Korean government plans to impose a capital gain tax on stock investments in 2025: 1) 20% on profits greater than KRW50 million and 2) 25% on profits greater than KRW300 million.

6) Except for transactions of borrowing shares for short sales.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.