The global soybean prices in 2023 are expected to drop slightly from 2022, as the expansion of arable land in major producers like Brazil and the increasing trend in production and exports from Argentina1 will contribute to an increase in the global soybean production for the 2022/2023 season. However, due to high production costs, particularly the prices of fertilizer, energy and transportation, the impact of global climate change and the uncertainty of the Russia-Ukraine crisis, the decline in global soybean prices may be limited amid the continued increase of global soybean demand, especially in China, the EU and the U.S. for domestic use including the manufacturing sector, alternative energy and building food security.

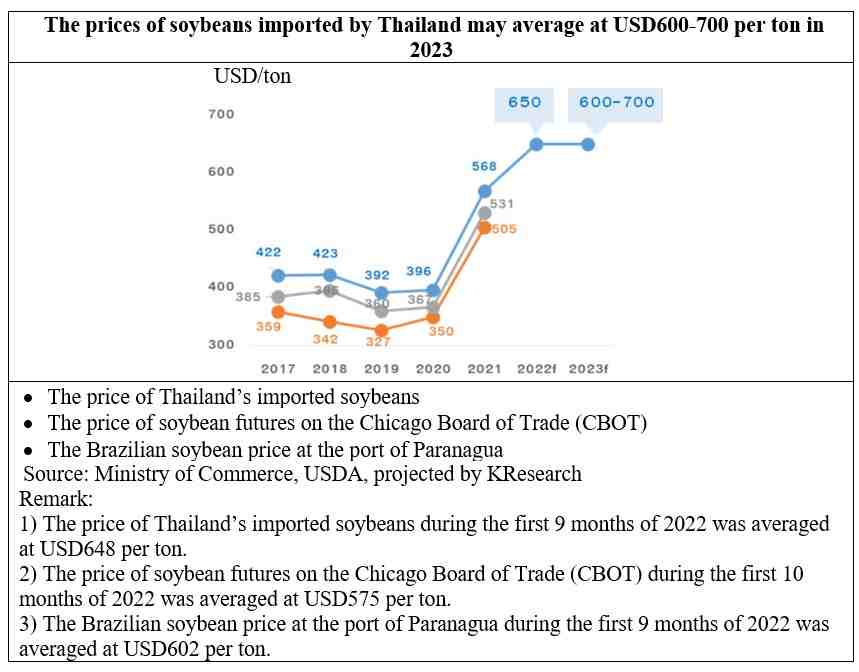

Thailand’s reliance on soybean imports is high at approximately 99% of domestic consumption, with Brazil as the main source of imports. Therefore, it is expected that Thailand’s soybean import prices should remain in line with global soybean prices. In addition, the Baht is tending to depreciate and experience volatility. As a result, KResearch projects that the soybean prices imported by Thailand will tend to remain high for the rest of the year 2022 through 2023. The prices of soybeans imported by Thailand are expected to stay in the range of USD600-700 per ton, compared to an expected average price of USD650 per ton in 2022, which is a record high.

The soybean demand in Thailand is expected to grow continuously2 in 2023, particularly the main demand from soybean processing business like soybean oil. This is driven by the need to serve demand from downstream customers including households and food service business (restaurant business/travel and service business) that are gradually recovering, as well as the demand from the vegetable oil export market that is expected to have more orders. With the growing demand for soybeans amid rising soybean prices, this reflects that business operators will still face a rising cost burden, including raw material costs (imported soybeans) and other production costs in Thailand such as energy costs (electricity-transportation) and labor costs. The degree of impact may vary depending on cost structure and flexibility of adaptation. For example, soybean oil production businesses may face limitation of substituting raw materials and have to bear higher production costs, while price increases are limited by the fact that vegetable oils are price-controlled goods and that lower-priced substitutes (palm oil) are available in the market. Animal feed businesses may adapt by changing the formula to use some other grains, but this also depends on the formula and the amount of nutrients the animal will receive at the same level as the original raw material.

Going forward, the production costs of businesses that rely on soybeans as raw materials such as soybean oil, soybean sauce, soy milk, soybean meal (animal feed) or soybeans for plant-based meat products remain in an uncertain and highly volatile situation, stemming from the rising trend in the businesses’ production costs, unstable climate that may affect production yields and global grain prices that are still under pressure from the Russia-Ukraine crisis. Therefore, business operators must closely monitor the situation and plan to cope with the aforesaid situations that may develop in the future.

------------------------------------------------------------

1 Brazil and Argentina are the world’s major producers and exporters of soybeans, accounting for 52% of the world’s total soybean production and 57% of the world’s total soybean exports.

2 Thailand’s demand for soybeans come from oil mill plants (accounting for approximately 75% of domestic soybean demand) and human food and animal feed processing plants (accounting for 25% of domestic soybean demand)

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.