Although the COVID-19 situation has abated, the increase in living costs and inflation rate continue to put pressure on consumer spending while beverage business operators continue to face increasing production costs. Therefore, KResearch projects that the total market value of Thailand’s beverages in 2022 will reach THB464 billion, up by 4.0%YoY from a low base in the previous year, driven by 2.8%YoY growth in consumption, which is supported by the resumption of more outdoor activities and the reopening policy to foreign tourists. Meanwhile, beverage prices are expected to rise by approximately 1.2% YoY as businesses are facing challenges in managing higher costs during this period, so a further 6-month delay in the third phase of the sugar tax increase should partially help reduce the production cost burden on the business operators.

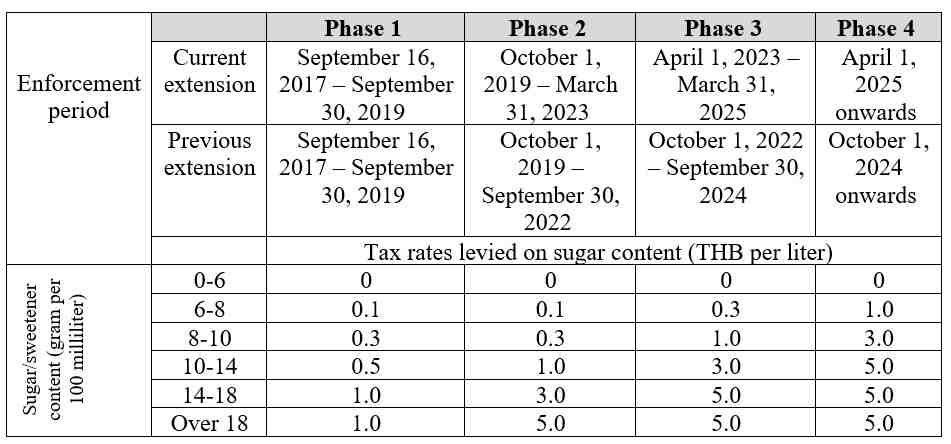

On September 20, 2022, the Cabinet approved the postponement of the third-phase of the excise tax increase on sugary beverages for another 6 months from the original effective date on October 1, 2022 to April 1, 2025, and postponed the effective date of the fourth phase of the tax to April 1, 2025. The tax rate levied on beverage operators remains unchanged this year. This will help alleviate the cost burden on operators that have to face continued increases in fuel and raw material costs, and buy more time for operators to adjust product formulas and develop production processes to support the next phase of a stricter taxation of sweetened beverages.

However, business operators still face pressing challenges from factors that put pressure on consumers’ purchasing power, including inflation and the gradual increase in prices of many products, causing people to remain cautious in their spending. As a result, the increase in product prices by business operators may not fully reflect the higher production costs. Beverage business operators may take advantage of the delay in the sugar tax increase to improve their low-sugar/low-energy beverage product to better meet the needs of consumers.

Going forward, the beverage industry must also monitor other tax developments that may affect production costs and future product development for health benefits, such as a 0% tax on beer, and a new tax on beverages like hemp-based drinks. Environmental issues consistent with consumer awareness of sustainability must also be taken into account such as the use of environmentally friendly packaging and the development of recall/reduction systems for post-consumer packaging waste in order to expand the market and improve long-term competitiveness.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.