The global cryptocurrency market has seen significant volatility and is in a downtrend since the beginning of 2022, mainly due to being hit by multiple confidence crises, such as the collapse of cryptocurrencies and stablecoins (LUNA and UST), the bankruptcy of major cryptocurrency lending platforms (Celsius Network and Babel Finance), and the closure of a major global cryptocurrency exchange (Mt.Gox). Meanwhile, the rising interest rates around the world have become a major contributor to the sell-off of risky assets like cryptocurrencies. This reinforces the volatility in the cryptocurrency market, where it is still difficult to find good fundamentals to support price movements. Currently, the global cryptocurrency market is worth approximately USD0.92 trillion1 , a huge drop of 58.6% from the beginning of 2022.

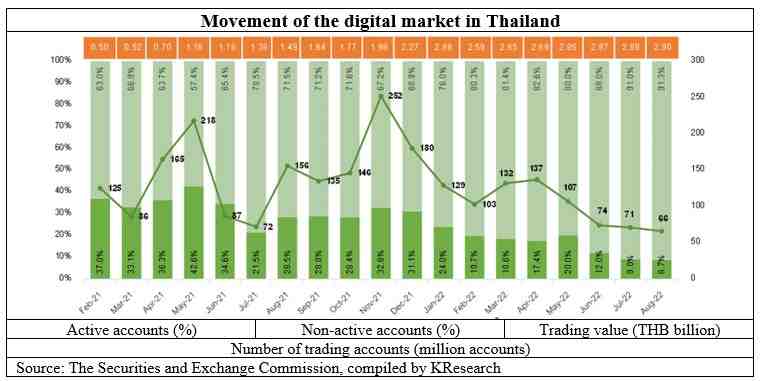

Looking at the cryptocurrency market or digital asset market in Thailand, the investment trend is moving in line with the global market. In August 2022, the trading value was THB66 billion, a decrease of 51.2% from January 2022. Meanwhile, the value of the Thai digital asset market remains low, and it accounts for only 2% of the value of Thailand’s stock market2 .

Investors in the Thai cryptocurrency market are still limited, especially concentrated among investors who can tolerate high risk. As of August 2022, the number of trading accounts stood at 2.9 million accounts, an increase of only 0.8% from January 2022, and accounted for just 0.52% of the number of securities trading accounts. Although the Thai cryptocurrency market is small both in terms of trading volume and number of investors, it is evident that the severe volatility and crises that occurred in the global cryptocurrency market have affected the operations of some digital asset trading centers in Thailand, and have had a considerable impact on the expected rate of return and the confidence of Thai investors.

As the aforesaid severe volatility and events should affect the confidence of Thai investors, KResearch has surveyed the behavior of cryptocurrency market investors in the form of a Focus Group3 and found the following key issues:

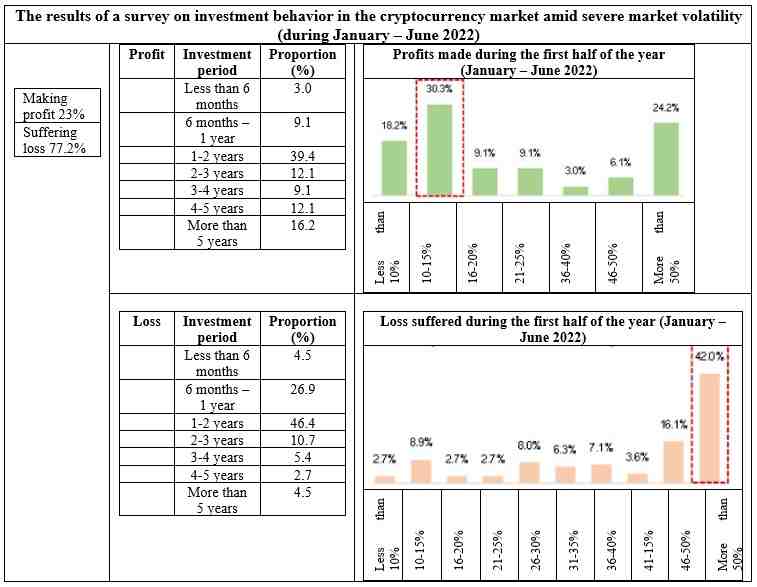

- During the first half of 2022 (January – June 2022), the majority or approximately 77.2% of Thai investors suffered losses, with most of them exceeding 50%. However, some investors were still able to make profits, and profits gained were in the range of 10-15%.

- Investment experience does not reduce losses during periods of severe market volatility. Investors with long-term investment experience may still suffer loss, while those who are beginners may also profit. This may depend on other factors as well, especially the timing of the investment.

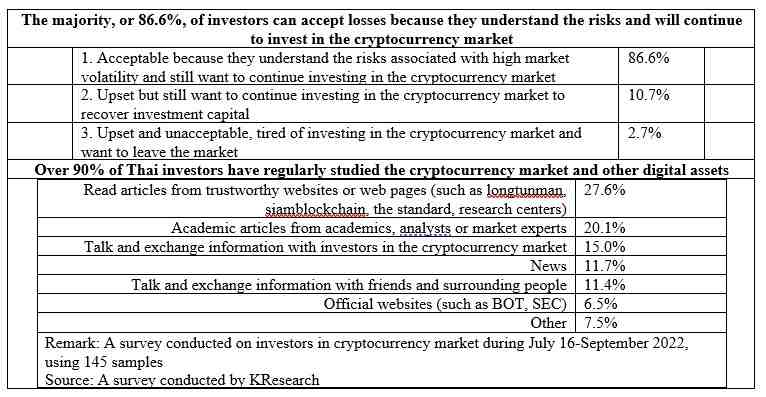

- Although most Thai investors in the cryptocurrency market suffered losses, 86.6% of investors are able to accept it and have chosen not to leave the market. While only a minority of 2.7% of investors feel upset and cannot bear the losses and want to leave the cryptocurrency market to invest in other financial assets. However, it is expected that most investors in the cryptocurrency market have invested in other financial assets, and cryptocurrency is just another alternative asset investment for risk diversification and speculation, or even an experiment to study the movements in the cryptocurrency market.

- In the severely volatile and risky cryptocurrency market, over 90% of Thai investors have regularly studied the cryptocurrency market and other digital assets. The 3 important learning sources are 1) websites or Facebook fan pages of trustworthy media and various research centers (27.8%); 2) academic articles by academics, analysts or market experts (20.1%); and 3) discussion among investors in the cryptocurrency market (15.0%).

While most cryptocurrency market investors are able to accept risks and losses and expect a return on their investment on the belief that the cryptocurrency market will recover in the near future, it is notable that most investors may not be able to explain the fundamental basis they are trading on, or why they are remaining in the cryptocurrency market.

Therefore, KResearch believes that the necessary elements for investors in the cryptocurrency market should include:

- Review the investment portfolio by taking into account good fundamentals and being able to assess economic values. Otherwise, investors would have to take higher risks than acceptable when risks are already at a high level.

- Understand the difference between investment and speculation. Investment in sustainable financial assets over the long-term requires fundamental support and can be assessed for economic value, while speculation may not require any information or fundamental support. Therefore, investors need to be alert and aware that their speculations can carry a high risk of damage to their holdings in the future.

- Be aware of the high volatility in the cryptocurrency market. The advertised profit opportunities are not always real, depending on different investment and sell-off timings.

- Keep learning and gaining understanding about the cryptocurrency market, because even if investors have studied and understood the information to a certain extent, it may not be enough to keep up with the market movements as market data and investment approaches are changing rapidly and becoming more complex.

- Stay alert and monitor the situation closely, so that investors can use it for the analysis of their investment decisions and stay afloat in the cryptocurrency market.

----------------------------------------------------------------------------------------------------

1 The market value of cryptocurrency market (Market Capitalization) as of September 26, 2022 (Source: coinmarketcap.com)

2 Compared to the stock market turnover in August 2022

3 A survey on investment behavior in the cryptocurrency market amid extreme volatility (January – Jun 2022) in the form of a Focus Group. There were 145 samples and the survey was conducted from July 16 to September 15, 2022.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.