Currently, Thailand is developing a digital currency, the Retail Central Bank Digital Currency (Retail CBDC), to be used as a medium of exchange for goods and services alongside existing payment methods such as cash, internet banking, mobile banking, e-money, debit cards, and credit cards. The retail CBDC is also considered as legal tender under the Currency Act of 1958.

Retail CBDC in Thailand is still in the pilot testing phase with the private sector. This aligns with many other countries worldwide that are also developing CBDCs for their citizens such as the Bahamas, Uruguay, Ukraine, Nigeria, and China. The use of retail CBDC is expected to enhance the efficiency and security of financial services for citizens, particularly in terms of money transfers and payments. It also aims to build confidence in Retail CBDC over potentially risky private sector digital currencies. Additionally, it presents an opportunity to reduce the costs associated with producing, storing and managing physical cash, facilitating a transition towards a cashless society.

For Thailand today, most Thai consumers prefer to transfer money to pay for goods and services through a variety of digital channels, including PromptPay (78.9 million accounts), Mobile Banking (101.8 million accounts) and e-Money (130.6 million accounts). If one compares the use of the aforementioned digital payment systems (especially PromptPay and Mobile Banking) with the Thai Baht Digital Currency, there are some similarities and differences.

The main similarities between the Thai Baht Digital Currency and Mobile Banking are:

1. Both use the Thai Baht as a medium of exchange to pay for goods and services and to settle debts legally under the Currency Act B.E. 2501.

2. Transactions can be made through online channels or mobile application. However, in the future, the government may open up offline channels for using the Thai Baht Digital Currency to support transactions in remote areas without internet access, as well as to support the use of the Thai Baht Digital Currency by the elderly.

3. Both can be used to transfer money between bank accounts.

4. There is no service charge.

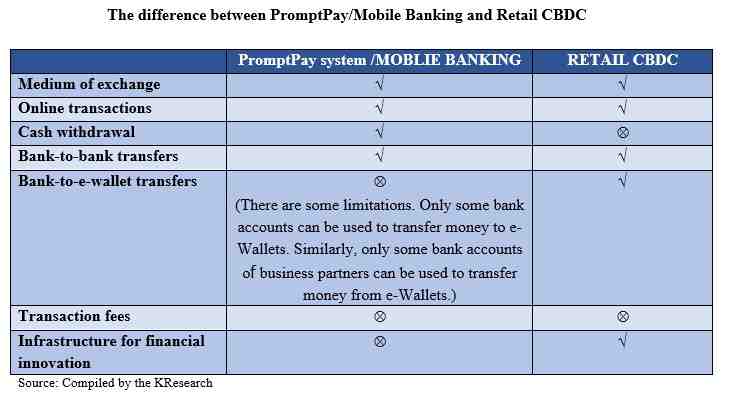

The main differences are:

1. The digital Baht system will be able to transfer money between bank accounts and e-Wallets of non-bank financial institutions (Non-banks) without any restrictions. Meanwhile, PromptPay or the mobile banking systems cannot transfer money from bank accounts to e-Wallets for all users, nor can they transfer money from e-Wallets to bank accounts for all users. This is only possible if they are business partners, and if so, a transfer fee is usually charged. This may make it more convenient for consumers to make transfer or payment transactions, which is one of the advantages of using the digital Baht.

2. Users of the PromptPay or mobile banking application can make cash withdrawal transactions, while the digital Baht system is likely to be designed in such a way that cash withdrawals are not available.

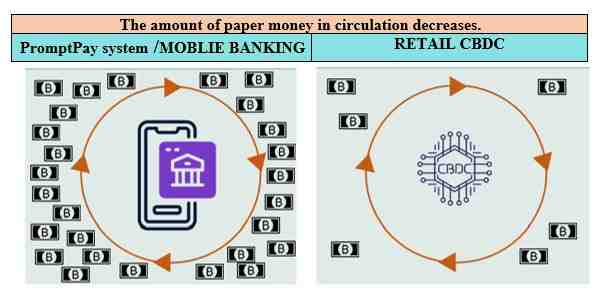

3. The digital Baht is a one-to-one replacement for paper currency. There will be no additional printing of banknotes or minting of coins, which will reduce the production and operating costs of the government and relevant sectors. If it were used more widely, the number of banknotes in the system would decrease. Meanwhile, the use of the PromptPay or Mobile banking system is only one of the payment and transfer channels. While this will reduce the cost of cash payments and withdrawals and cash management, the number of banknotes in circulation in the system remain unchanged,

4. The back-end technology systems are different. Blockchain technology will allow the digital Baht to directly address the needs of delivering fiscal policies to the target group of the public and provide targeted assistance to the public under transparent, real-time verifiable transactions and high security. For example, by providing financial assistance to low-income people to buy essential goods and services in their daily life, the government will be able to identify and restrict the types of essential goods and services, and monitor transactions to prevent the misuse of money more efficiently. Mobile banking, on the other hand, will use the systems and technologies of each bank connected through a central system such as ITMX (Interbank Transaction Management and Exchange) to perform the functions of checking, linking and transferring payment and transfer transaction data between banks.

5. The digital Baht is also expected to stimulate the development of financial innovation due to transaction safety and to reduce the risk of using other digital assets that may have high price volatility. For example, the digital Baht may be used as a medium of exchange for digital assets or as collateral on the digital asset trading platforms in the future. This is likely to make investors more confident and lead to more investment and the development of new financial innovations. For mobile banking, innovation can be achieved through the development of IT systems and the integration with other platforms. This depends on the business models of each institution and its specific technological capabilities.

In summary, the widespread use of Retail CBDC still requires close monitoring, not only as a medium of exchange for goods and services but also in terms of the development of financial innovation. This depends on the clear direction and goals of the authorities on how to promote the use of both perspectives. Such clarity will help the public and investors to have confidence and see the advantages or differences from using financial services as they are now in order to increase wider use in the future.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.