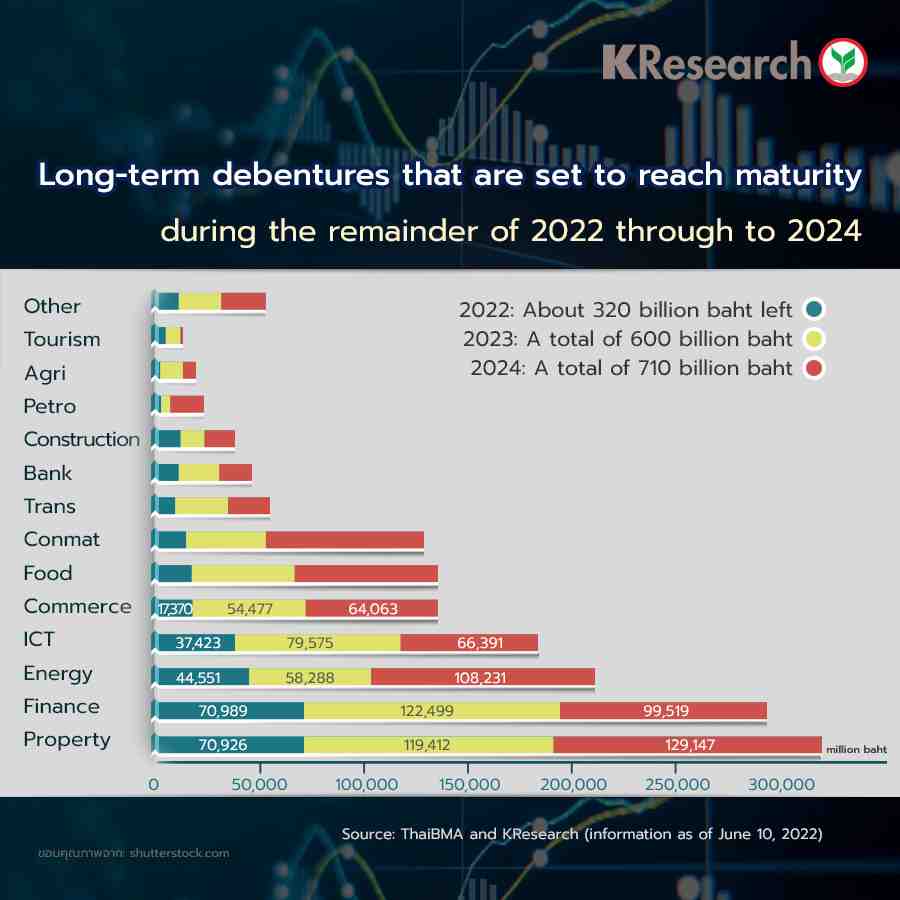

The pressure on financial costs in Thailand is increasing in line with the global market trend, after the results of the latest Monetary Policy Committee (MPC) meeting reflect the likelihood of a policy rate hike at the MPC meeting in August 2022. In spite of this, KResearch is of the view that the yields of several tenors of Thai government bonds, particularly those with the maturity of less than two years, will likely increase further in line with policy rate hikes. Despite the anticipated increases in Thai government bond yields, the narrowing credit spread between debentures and government bonds will be a key factor helping ease the private sector’s financial costs somewhat. Looking ahead, the recovering economy, a more stable credit spread between debentures and government bonds and the upward trend in Thai interest rates may induce the private sector to mobilize more funds via the issuance of debentures for the purposes of replacing those that are scheduled to reach maturity and expanding their businesses during the remainder of 2022. Given this, we at KResearch project that the value of long-term debentures to be issued during 2022 will reach within a range of THB1.10-1.20 trillion, which would exceed THB1 trillion for the second consecutive year. In 2021, the value of issued debentured totaled THB1.02 trillion. Meanwhile, close attention must be paid to the fact that approximately THB1.65 trillion in long-term debentures are set to mature during the remainder of 2022 through to 2024.

Scan QR Code

Annotation

This research paper is published for general public. It is made up of various sources. Trustworthy, but the company can not authenticate. reliability The information may be changed at any time without prior notice. Data users need to be careful about the use of information. The Company will not be liable to any user or person for any damages arising from such use. The information in this report does not constitute an offer. Or advice on business decisions Anyhow.